Gift Tax Limit 2024 Lifetime

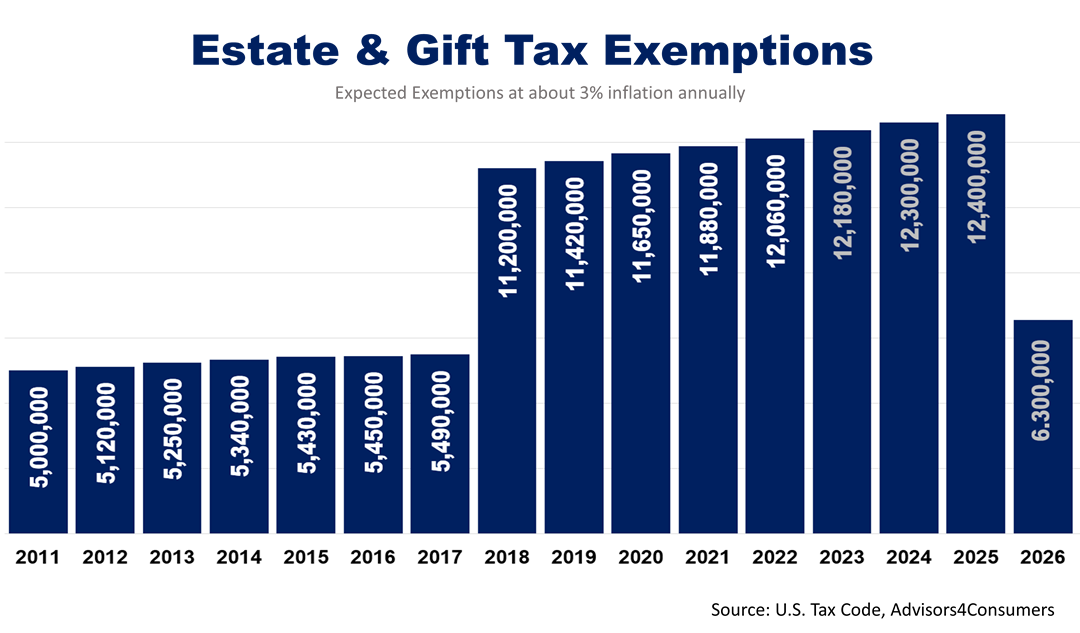

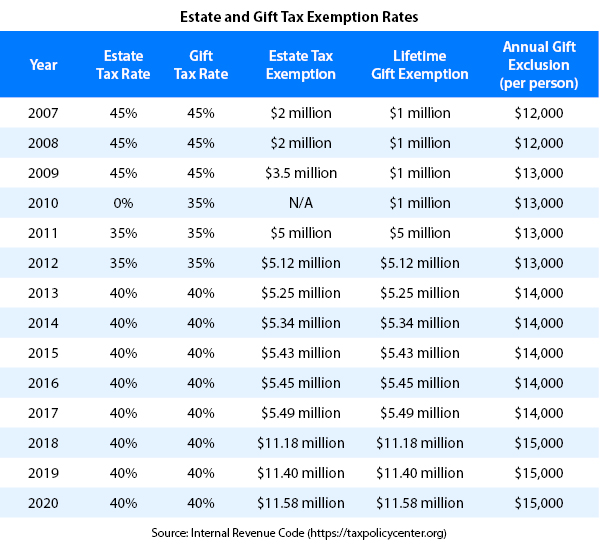

Gift Tax Limit 2024 Lifetime. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in. In 2024, this limit rises to $13.61 million, allowing substantial tax.

For married couples, the limit is $18,000 each, for a total of $36,000. Essential filing tips for 2024 story by elizabeth constantineau, ai editor • 1mo • 4 min read understanding the gift tax and its limits is crucial when.

For Married Couples, The Limit Is $18,000 Each, For A Total Of $36,000.

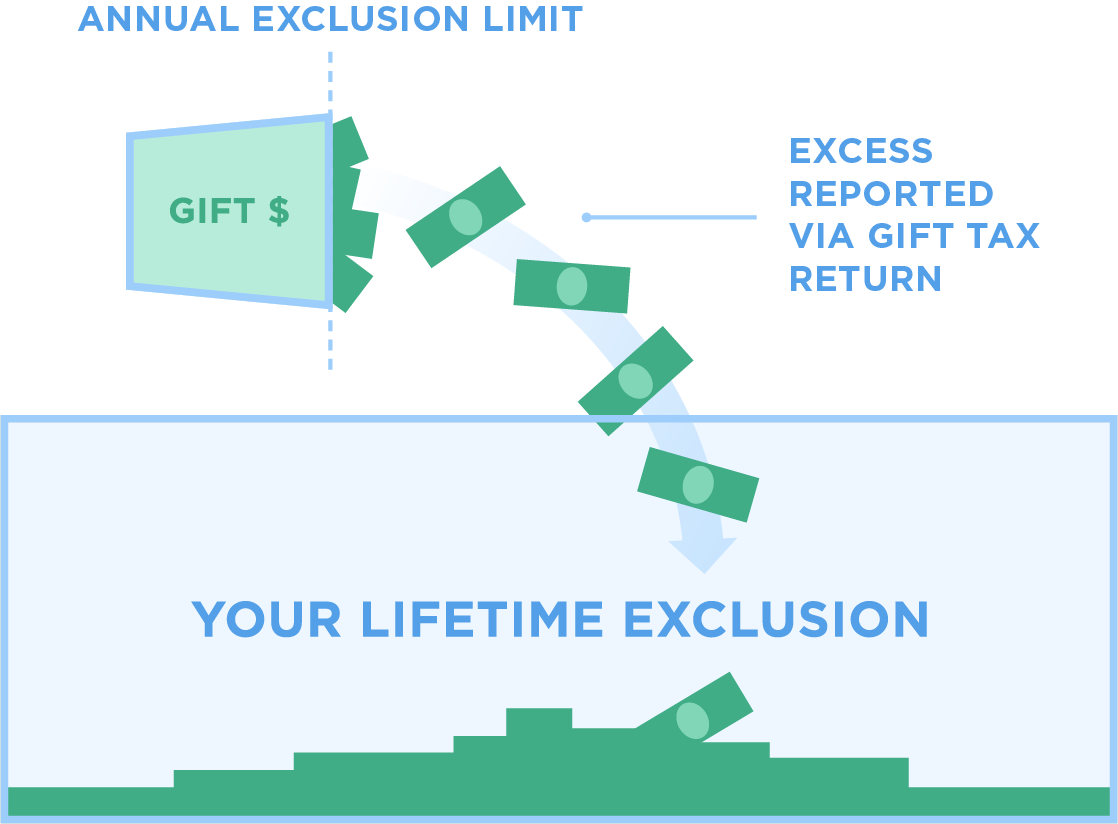

This limit is called the lifetime, or combined, gift and estate tax exemption.

That’s Because The Irs Allows You To Give Away Up To $18,000 In 2024 And $17,000 In 2023 In Money Or Property To As Many People As You Like Each.

For 2024, the federal gift tax is $18,000 for individuals and $36,000 for couples.

For Example, You Only Have To File A Gift Tax Return.

Essential filing tips for 2024 story by elizabeth constantineau, ai editor • 1mo • 4 min read understanding the gift tax and its limits is crucial when.

Images References :

Source: www.wealthmanagement.com

Source: www.wealthmanagement.com

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, The 2024 rrsp contribution limit is equal to the lesser of 18% of earned income for 2023 and a maximum amount of $31,560. In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, Currently, you can give any number of people up to $17,000 each in a single year without incurring a taxable gift ($34,000 for spouses splitting gifts)—up from. The lifetime limit increases to $13.6 million in 2024.

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, The 2024 rrsp contribution limit is equal to the lesser of 18% of earned income for 2023 and a maximum amount of $31,560. For example, you only have to file a gift tax return.

Source: www.carboncollective.co

Source: www.carboncollective.co

Gift Tax Limit 2022 Explanation, Exemptions, Calculation, How to Avoid It, Annual gift tax limit for 2024. Additionally, the federal gift tax annual exclusion amount.

Source: alis.biz

Source: alis.biz

ACG product ALIS News 2022 Estate & Gift Tax Planning For Large, For example, you only have to file a gift tax return. This is an increase of $1,000 from 2023.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax, Now, estates and lifetime gifts valued at $13.6 million are exempt. Most people don’t have to worry about this tax thanks to annual and lifetime exclusions.

Source: credit.ly

Source: credit.ly

The Best Credit Repair What is the Gift tax? How the Annual Gift Tax, Gifting more than this sum. This means that you can give up to $13.61 million in gifts.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, For 2024, the annual gift tax limit is $18,000. For married couples, the limit is $18,000 each, for a total of $36,000.

Source: allianceam.com

Source: allianceam.com

Can making lifetime gifts really reduce your tax liability in the future?, Additionally, the federal gift tax annual exclusion amount. Gifting more than this sum.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, With a sunset, these numbers would drop to $5. (as noted above, the gift tax rules are really set up to permit most gifts.) if you die during 2024, there is no tax implication on $13.61 million in total gifts given during.

Annual Gift Tax Limit For 2024.

Annual federal gift tax exclusion.

The Gift Tax Exemption For 2024 Is $18,000 Per Gift Recipient.

For married couples, the limit is $18,000 each, for a total of $36,000.

The 2024 Rrsp Contribution Limit Is Equal To The Lesser Of 18% Of Earned Income For 2023 And A Maximum Amount Of $31,560.

(as noted above, the gift tax rules are really set up to permit most gifts.) if you die during 2024, there is no tax implication on $13.61 million in total gifts given during.

Category: 2024