Corporation Tax Rates 2024 Trinidad

Corporation Tax Rates 2024 Trinidad. The salary tax calculator for trinidad and tobago income tax calculations. The finance bill, 2024, was passed in parliament yesterday.

The orbitax global minimum tax solution now supports the generation of the belgium p2 notification form in xml format. 75:02 and will result in an estimated tax loss of $8 million.

Corporation Tax Rates 2024 Trinidad Images References :

Source: tt.icalculator.com

Source: tt.icalculator.com

Trinidad and Tobago Tax Tables 2024 Tax Rates and Thresholds in, Corporation tax, business levy, and green fund levy are payable quarterly in advance on 31 march, 30 june, 30 september, and 31 december.

Source: tamiqalverta.pages.dev

Source: tamiqalverta.pages.dev

Corporation Tax Rates 2024/2024 Greer Agnesse, Updated for 2024 with income tax and social security deductables.

Source: jobihillary.pages.dev

Source: jobihillary.pages.dev

Corporation Tax Rates 2024/25 Bliss Tiffani, Corporate tax rate in trinidad and tobago averaged 26.92 percent from 2012 until 2024, reaching an all time high of 30.00 percent in 2020 and a record low of 25.00.

Source: trinidadlaw.com

Source: trinidadlaw.com

2024 TAX LANDSCAPE IN TRINIDAD AND TOBAGO WHAT TO EXPECT? Lawyers, A corporation engaged in business in trinidad and tobago may claim a deduction for royalties, interest, and service charges paid to foreign affiliates, provided the appropriate wht is.

Source: efiletaxonline.com

Source: efiletaxonline.com

2024 State Corporate Tax Rates & Brackets, Gains on the disposal of chargeable assets within 12 months of acquisition are subject to tax at standard corporation tax rates.

Source: americanlegaljournal.com

Source: americanlegaljournal.com

Corporate Tax Rates By Country Corporate Tax Trends American Legal, Corporate tax rate in trinidad and tobago averaged 26.92 percent from 2012 until 2024, reaching an all time high of 30.00 percent in 2020 and a record low of 25.00.

Source: lissabcarolee.pages.dev

Source: lissabcarolee.pages.dev

What Is Corporation Tax Rate 2024 Kimmi Merline, He said in this current amnesty, the government expected to collect $1.5 billion from 20,000 people/businesses.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, These companies are also entitled to an exemption from corporation tax for the first five (5) years following listing, as well as a 50% reduction in their corporation tax rate for.

Source: tradingeconomics.com

Source: tradingeconomics.com

Trinidad And Tobago Corporate Tax Rate 2022 Data 2023 Forecast, Finance minister colm imbert piloted the finance bill 2024.

Source: taxesalert.com

Source: taxesalert.com

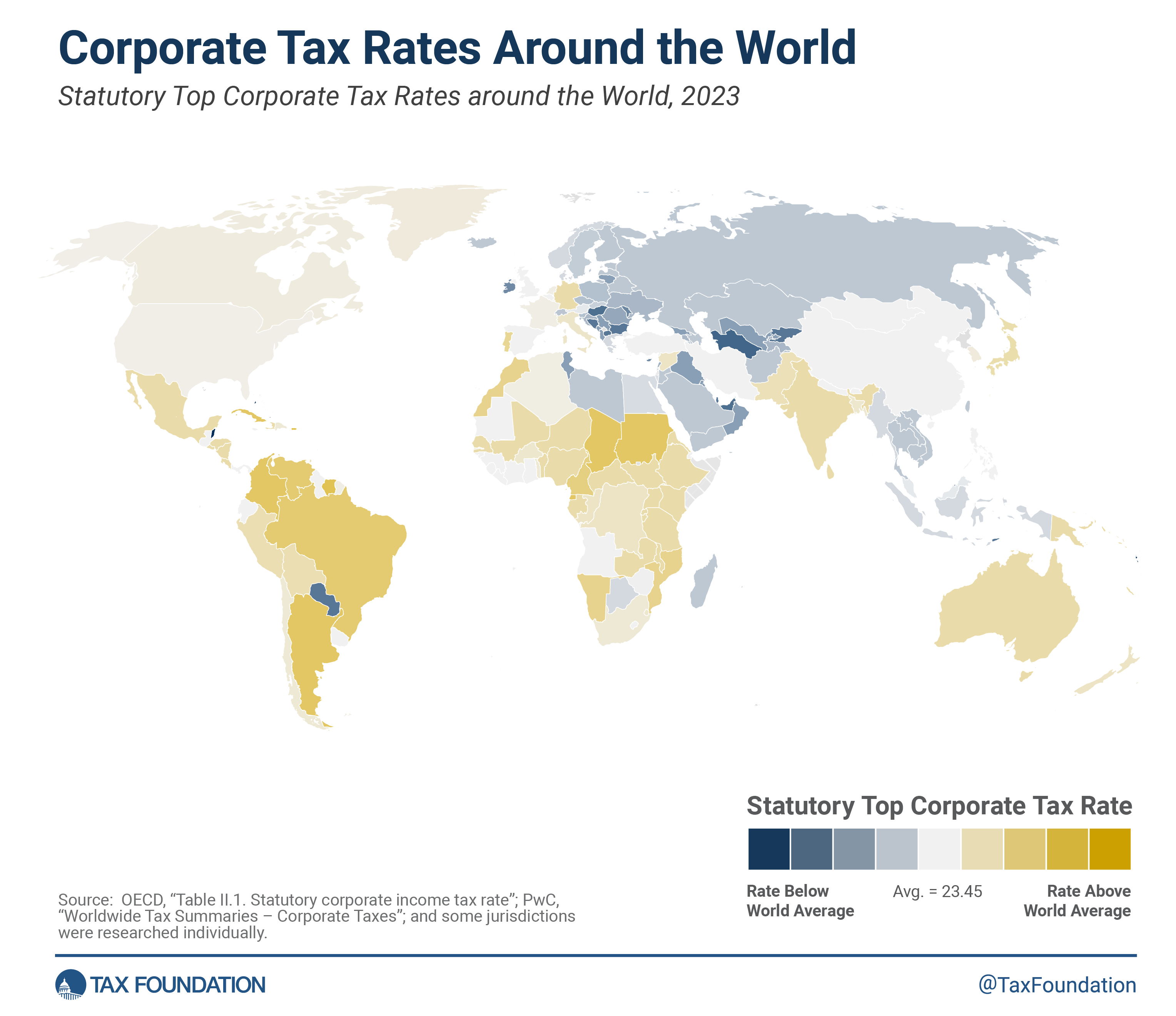

Corporate Tax Rates around the World, 2023 Taxes Alert, Trinidad and tobago — orbitax corporate tax rates.

Posted in 2024