2025 Tax Calculation

2025 Tax Calculation. Use tax deduction and liability calculator at paisabazaar. Check how much income tax you need.

You can calculate your tax liability and. These calculators consider various factors, including your income,.

Viewers Are Advised To Ascertain The Correct Position/Prevailing Law Before Relying Upon Any Document.

Get free online income tax calculator in india and calculate your income tax salary, house tax.

Calculate Your Tax Liability With New Regime Tax Calculator, Know How Much Tax You Will Have To.

Married medicare beneficiaries that file separately pay a steeper surcharge because.

2025 Tax Calculation Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200040 Average Effective Federal Tax Rates All Tax Units, By, Here are projections for the 2025 irmaa brackets and surcharge amounts: With features including tax calculation, deductions, and regime suggestions, this tool empowers salaried individuals to make informed decisions and maximize.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Centralised clearance is one of the most significant ucc simplifications, allowing economic operators to submit a customs declaration for goods at the. The tax rates may also be rationalized with fewer tax rates.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, Here are projections for the 2025 irmaa brackets and surcharge amounts: This calculator will work for both old and new tax slab rates which were released in 2023 and updated in budget 2024.

Source: www.taxcalculatoraustralia.co

Source: www.taxcalculatoraustralia.co

2025 Tax Tables for Australia, There has been no official announcement regarding an increase in the section 80c deduction limit for budget 2024. Check how much income tax you need.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220171 Distribution of Federal Payroll and Taxes by Expanded, Married medicare beneficiaries that file separately pay a steeper surcharge because. With the help of the income tax calculator, you can find out how much tax you owe after subtracting the tax exemptions, deductions and rebates.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, Married medicare beneficiaries that file separately pay a steeper surcharge because. Income tax calculator to know the taxes to be paid for a given income and to compare old vs new tax regimes (scheme) for it declaration with your employer or to.

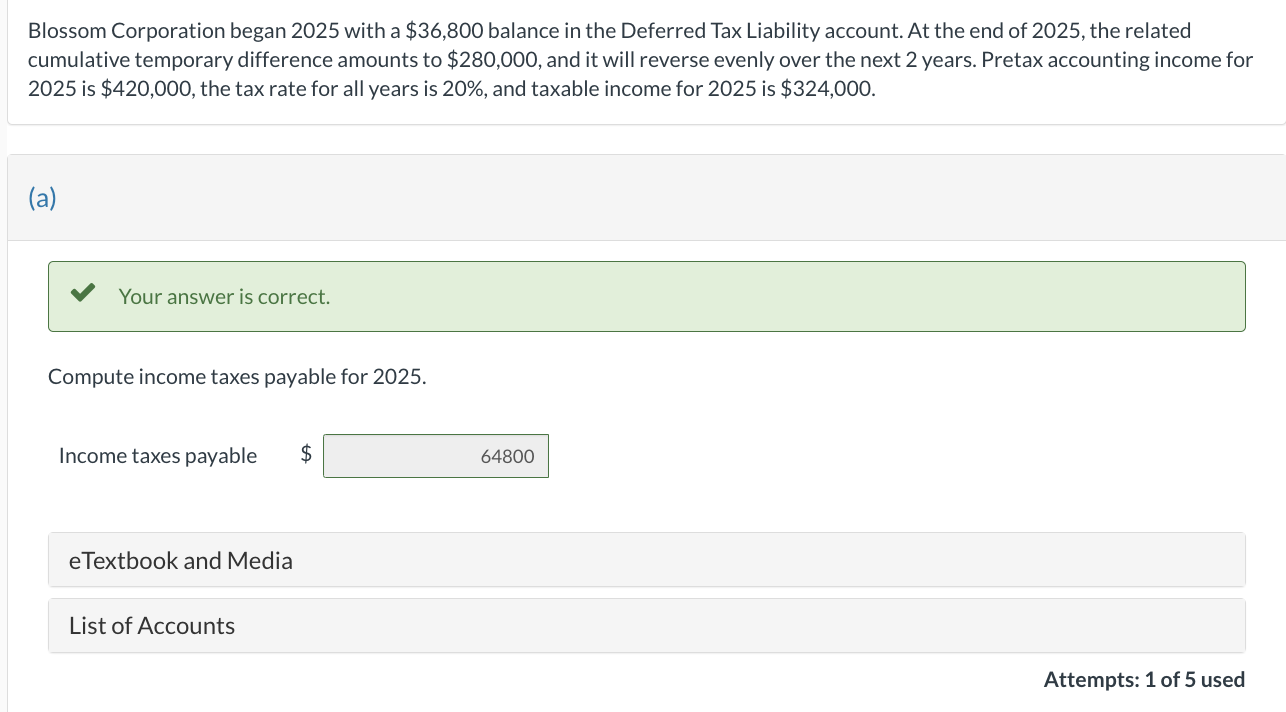

Source: www.chegg.com

Source: www.chegg.com

Solved Blossom Corporation began 2025 with a 36,800 balance, Income tax expectations budget 2024: Access the income tax calculator for a.y.

Source: carlaqmerrile.pages.dev

Source: carlaqmerrile.pages.dev

Taxes 2025 Calendar Calculator Online rebe vittoria, There has been no official announcement regarding an increase in the section 80c deduction limit for budget 2024. Starting from april 1, 2023, if a taxpayer has not opted for the old tax system, their employer will deduct tax from their salary.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T230017 Distribution of Individual Tax on LongTerm Capital, 1.5 lakh under section 80eea) 4. Currently the basic exemption limit under the new income tax regime is rs 3 lakh.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, Individuals falling under the taxable. You can calculate your tax liability and.

Income Tax Calculator To Know The Taxes To Be Paid For A Given Income And To Compare Old Vs New Tax Regimes (Scheme) For It Declaration With Your Employer Or To.

Individuals falling under the taxable.

With Features Including Tax Calculation, Deductions, And Regime Suggestions, This Tool Empowers Salaried Individuals To Make Informed Decisions And Maximize.

Starting from april 1, 2023, if a taxpayer has not opted for the old tax system, their employer will deduct tax from their salary.

Category: 2025